You may also like:

- Top 8 Health Trends

- 19 Skyrocketing Supplement Startups

- 9 Key Consumer Behavior Trends

58% of U.S. adults take supplements.

Not only that, but according to Statista, the average spend per trip on these products is $96.49.

Today we’re going to cover 6 important supplement trends for 2021-2023.

From collagen’s continued growth to entirely new categories, this list will help you see what’s coming around the corner in the dietary supplement industry.

1. New Supplement Categories

The dietary supplement market was estimated to be worth $156.2 billion in 2020.

One industry study forecasts that this will rise as high as $230.7 billion by 2027 (CAGR of 8.6%).

Some of this growth will come from established supplement categories.

(Like multivitamins, Vitamin D and whey protein powder).

But good chunk of the growth in this space will come from entirely new product categories.

For example, sleep gummies.

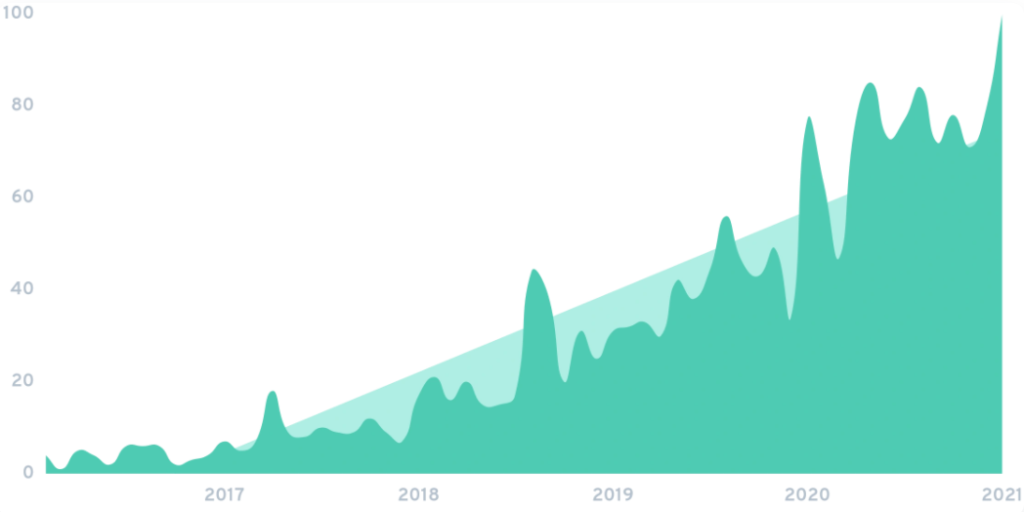

Search growth of “sleep gummies” are up 1466% over 5 years.

Sleep gummies are a gummy supplement containing compounds and nutrients that aid in sleep (including magnesium and melatonin).

And searches in Google for sleep gummies have increased by 1128% over the last 5 years.

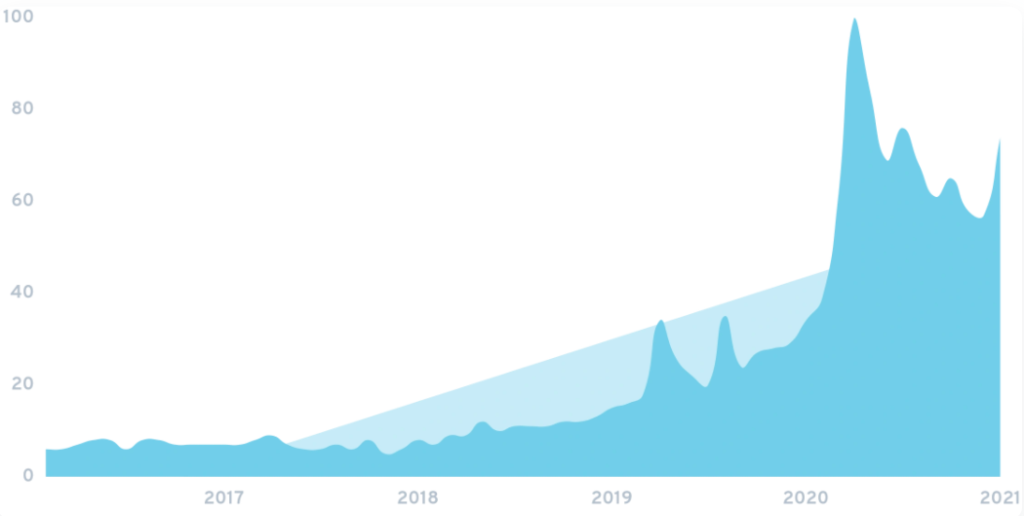

Another new, growing supplement category is irish moss.

Searches for “irish moss” dipped a bit in the winter of 2020. But is starting to rebound.

Irish moss is commonly used as a supplement to aid in digestion and fertility. Search volume for irish moss is up 7.2x since 2016.

Finally, we’ve got turmeric coffee.

Turmeric was one of the biggest supplement trends of the last 5 years.

And turmeric “coffee” (essentially coffee with powdered turmeric) is taking off right now.

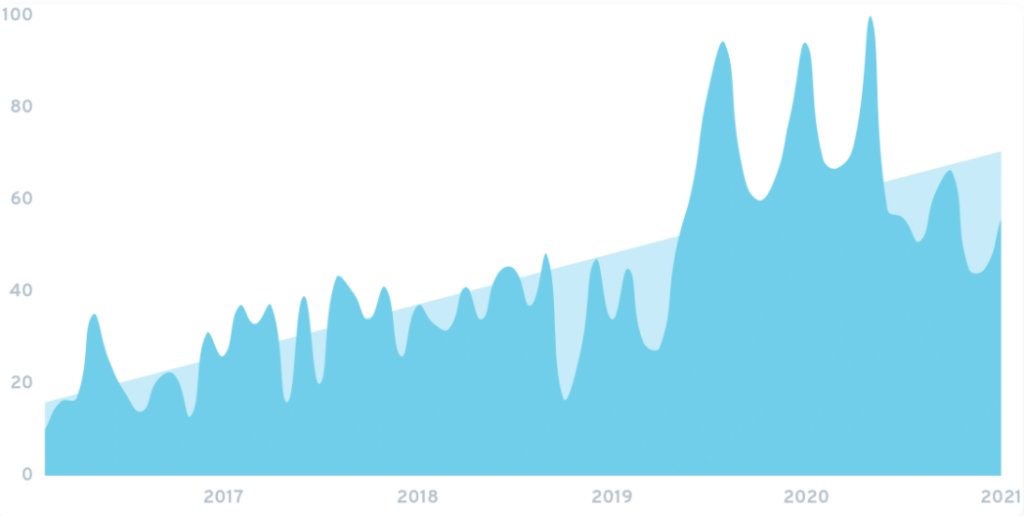

Finally, we have mushroom coffee.

Mushroom coffee uses powder ground from fungi such as lion’s mane, cordyceps and chaga.

This is then mixed with regular instant coffee.

Mushroom coffee tastes somewhat similar to regular coffee.

But the reduced coffee component means there’s less caffeine.

Other purported health benefits depend on the mushroom blend. For example, some aim to regulate blood sugar levels or be a valuable source of unique minerals and antioxidants.

2. Demand For Collagen Grows

An analysis by Grand View Research estimates that the collagen space is growing by 5.9% annually.

The collagen category is growing largely because collagen has a wide range of applications and use cases.

Most people take collagen to help improve skin, hair and joint health.

However, approximately 15% of all collagen is used in cosmetics.

This use case blurs the line between supplements and makeup.

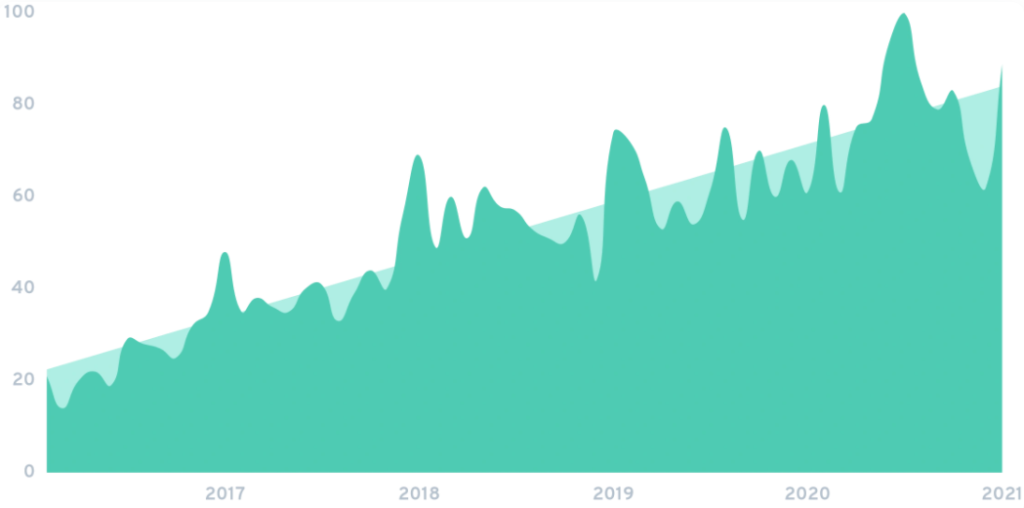

Google searches for the term “collagen” itself has grown by 212% since early 2017.

And we’re also seeing big spikes in demand for niche collagen products.

For example, fish collagen (aka “marine collagen”.)

As the name suggests, fish collagen is collagen derived from fish.

Which makes it an accessible alternative to traditional collagen for people that don’t eat meat.

And studies suggest that fish collagen supplementation has similar effects as bovine collagen.

3. Gummies Becomes A Mainstream Supplement Form

For many people, CBD gummies helped solidify gummies as a convenient and tasty way to take supplements

Over the last 2-3 years, an increasing number of supplements have been “gummified”.

For example, apple cider vinegar gummies.

Interest in apple cider vinegar has been growing for some time now (largely thanks to its potential for boosting the immune system).

With many people downing “ACV shots”.

Or creating drinks that attempt to mask the bitter flavor of apple cider vinegar.

However, gummies are quickly becoming the most popular way to take ACV.

Other examples of growing gummy supplement categories include elderberry gummies, turmeric gummies and hair gummies.

4. Pet Supplements Take Off

31% of dog owners bought over-the-counter pet supplements in the past year.

And search demand for pet supplements is on the rise.

Besides improving their pet’s overall wellness, reasons that owners give their pets supplements include boosting joint health, improving coat appearance, and optimizing heart health.

Interestingly, many popular pet supplements mirror those that humans take.

For example, searches for “CBD for dogs” has increased by 2166% over the last 5 years.

Another human-inspired pet supplement category is probiotics for pets

Like humans, dogs and cats have a microbiome.

And probiotic and prebiotic supplementation may aid in animal gut health as well.

5. Growing Number Of Vegan Supplements

Approximately 5-8% of Americans follow some form of vegetarian or vegan diet.

Which is why a growing number of Americans are seeking out vegan-friendly supplements.

(Especially vegan versions of popular supplements that typically contain animal ingredients).

Or supplements to prevent deficiencies that can occur while following a vegan diet.

One example of a growing vegan supplement is vegan collagen.

While actual collagen does need to derive from animals, many vegan collagen supplement manufacturers are attempting to recreate collagen from plant-based ingredients.

Or simply market nutrients that boost skin and nail health as “vegan collagen”.

6. More DTC Supplement Brands

Thanks largely to the pandemic, 2020 was a huge year for the direct-to-consumer space.

Like many industries (including healthcare), the supplement industry was impacted by the rapid growth of the ecommerce sector.

Specifically, we’re seeing a growing number of nutritional supplement brands go 100% DTC.

In other words: instead of competing to get their supplement on the shelves at GNC, they’re selling their products 100% online.

Either from their own website. Or via Amazon.

Truvani is an example of a fast-growing DTC supplement brand.

Truvani is a DTC supplement brand that focuses on a handful of trending supplement categories, like turmeric powder, pea protein and marine collagen.

And searches for the brand are up 26 % over the last two years.

Another popular DTC supplement brand is Ancestral Supplements.

They specialize in paleo and keto-focused supplements (part58% of U.S. adults take supplements.

Not only that, but according to Statista, the average spend per trip on these products is $96.49.

Today we’re going to cover 6 important supplement trends for 2021-2023.

From collagen’s continued growth to entirely new categories, this list will help you see what’s coming around the corner in the dietary supplement industry.

1. New Supplement Categories

The dietary supplement market was estimated to be worth $156.2 billion in 2020.

One industry study forecasts that this will rise as high as $230.7 billion by 2027 (CAGR of 8.6%).

Some of this growth will come from established supplement categories.

(Like multivitamins, Vitamin D and whey protein powder).

But good chunk of the growth in this space will come from entirely new product categories.

For example, sleep gummies.

Sleep gummies are a gummy supplement containing compounds and nutrients that aid in sleep (including magnesium and melatonin).

And searches in Google for sleep gummies have increased by 1128% over the last 5 years.

Another new, growing supplement category is irish moss.

Irish moss is commonly used as a supplement to aid in digestion and fertility. Search volume for irish moss is up 7.2x since 2016.

Finally, we’ve got turmeric coffee.

Turmeric was one of the biggest supplement trends of the last 5 years.

And turmeric “coffee” (essentially coffee with powdered turmeric) is taking off right now.

Finally, we have mushroom coffee.

Mushroom coffee uses powder ground from fungi such as lion’s mane, cordyceps and chaga.

This is then mixed with regular instant coffee.

Mushroom coffee tastes somewhat similar to regular coffee.

But the reduced coffee component means there’s less caffeine.

Other purported health benefits depend on the mushroom blend.

For example, some aim to regulate blood sugar levels or be a valuable source of unique minerals and antioxidants.

One of the leading mushroom coffee brands, Four Sigmatic, generates “eight figures” per year.

2. Demand For Collagen Grows

An analysis by Grand View Research estimates that the collagen space is growing by 5.9% annually.

And one leading collagen brand, Vital Proteins, generates an estimated $250 million in annual revenue.

The collagen category is growing largely because collagen has a wide range of applications and use cases.

Most people take collagen to help improve skin, hair and joint health.

However, approximately 15% of all collagen is used in cosmetics.

This use case blurs the line between supplements and makeup.

Google searches for the term “collagen” itself has grown by 212% since early 2017.

And we’re also seeing big spikes in demand for niche collagen products.

For example, fish collagen (aka “marine collagen”.)

As the name suggests, fish collagen is collagen derived from fish.

Which makes it an accessible alternative to traditional collagen for people that don’t eat meat.

And studies suggest that fish collagen supplementation has similar effects as bovine collagen.

3. Gummies Becomes A Mainstream Supplement Form

For many people, CBD gummies helped solidify gummies as a convenient and tasty way to take supplements

Over the last 2-3 years, an increasing number of supplements have been “gummified”.

For example, apple cider vinegar gummies.

Interest in apple cider vinegar has been growing for some time now (largely thanks to its potential for boosting the immune system).

With many people downing “ACV shots”.

Or creating drinks that attempt to mask the bitter flavor of apple cider vinegar.

However, gummies are quickly becoming the most popular way to take ACV.

ACV gummies were one of the first mainstream gummy supplements.

In fact, searches for ACV gummy brand Goli Gummies have increased significantly in 2021.

Searches for Goli Gummies are up 650% over the last 24 months.

Other examples of growing gummy supplement categories include elderberry gummies, turmeric gummies and hair gummies.

4. Pet Supplements Take Off

31% of dog owners bought over-the-counter pet supplements in the past year.

And search demand for pet supplements is on the rise.

Besides improving their pet’s overall wellness, reasons that owners give their pets supplements include boosting joint health, improving coat appearance, and optimizing heart health.

Interestingly, many popular pet supplements mirror those that humans take.

For example, searches for “CBD for dogs” has increased by 2166% over the last 5 years.

Another human-inspired pet supplement category is probiotics for pets.

Like humans, dogs and cats have a microbiome.

And probiotic and prebiotic supplementation may aid in animal gut health as well.

5. Growing Number Of Vegan Supplements

Approximately 5-8% of Americans follow some form of vegetarian or vegan diet.

Which is why a growing number of Americans are seeking out vegan-friendly supplements.

(Especially vegan versions of popular supplements that typically contain animal ingredients).

Or supplements to prevent deficiencies that can occur while following a vegan diet.

While actual collagen does need to derive from animals, many vegan collagen supplement manufacturers are attempting to recreate collagen from plant-based ingredients.

Or simply market nutrients that boost skin and nail health as “vegan collagen”.

6. More DTC Supplement Brands

Thanks largely to the pandemic, 2020 was a huge year for the direct-to-consumer space.

Like many industries (including healthcare), the supplement industry was impacted by the rapid growth of the ecommerce sector.

Specifically, we’re seeing a growing number of nutritional supplement brands go 100% DTC.

In other words: instead of competing to get their supplement on the shelves at GNC, they’re selling their products 100% online.

Either from their own website. Or via Amazon.

Conclusion

That wraps up this list of impactful trends in the supplement industry.

The one thread that ties many of these trends together is the fact that many new health supplements categories cater to small, niche audiences. While mainstream supplements (like calcium and vitamin C) will have their place in the future, we can expect much of the growth in the supplement space to be driven by new products that appeal to smaller groups.